Military retirement and survivor benefit income are now fully exempt from Indiana's income tax.

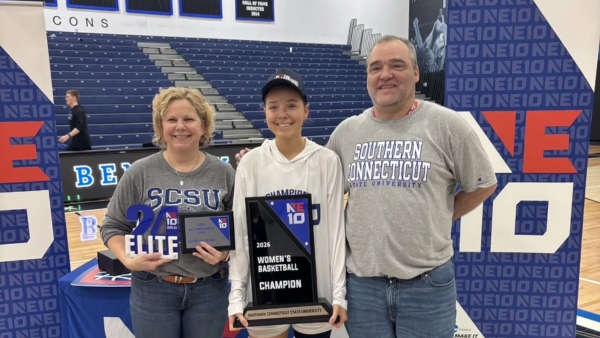

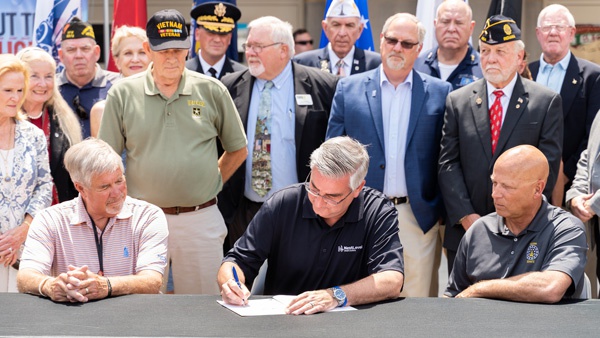

Indiana Governor Eric Holcomb was joined by military veterans as he signed House Enrolled Act 1010 at the Indiana State Fair on Monday, August 5. Public domain photo.

(Indianapolis, Ind.) - Veterans in Indiana don't have to worry about income taxes on their pensions or other military benefits.

Governor Eric Holcomb ceremonially signed a new law Monday at the Indiana State Fair.

It gives former service members a tax break. House Enrolled Act 1010 allows a 100 percent income tax deduction on military retirement or survivor's benefits beginning this year. The exemption also applies to military spouses.

RELATED: LEGION Act Could Help Boost Post Numbers

Lawmakers approved the law with the hope that the tax break will keep more veterans in Indiana after they stop working.

The tax exemption will reduce the State of Indiana’s income tax revenue by about $15 million per year, according to a fiscal analysis of the law by the non-partisan Legislative Services Agency.

RELATED STORIES:

Indiana Court of Appeals Upholds Guilfoyle's Attempted Murder Convictions

Indiana Court of Appeals Upholds Guilfoyle's Attempted Murder Convictions

Indiana Secretary of State Launches Voter Registration and Poll Worker Recruitment Initiative

Indiana Secretary of State Launches Voter Registration and Poll Worker Recruitment Initiative

Luke Schwegman Mental & Behavioral Wellness Fund Established

Luke Schwegman Mental & Behavioral Wellness Fund Established

Jennings County Woman Arrested for Battery on a Child

Jennings County Woman Arrested for Battery on a Child

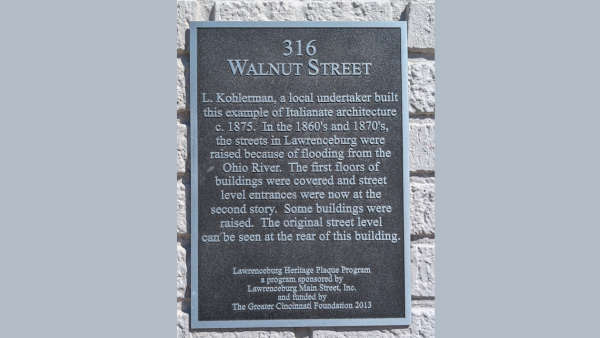

History Flows in Lawrenceburg

History Flows in Lawrenceburg

Local Schools Compete at 15th Annual Rube Goldberg Machine Contest

Local Schools Compete at 15th Annual Rube Goldberg Machine Contest