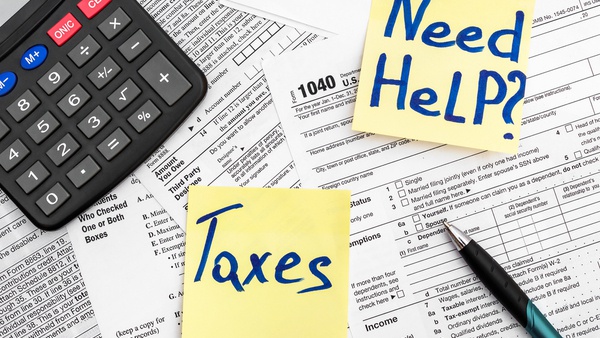

Low to moderate income taxpayers may be eligible.

Shutterstock photo

CINCINNATI - The United Way of Greater Cincinnati is offering free tax preparation and filing help for eligible citizens.

How Does It Work?

Visit one of United Way's tax sites to have an IRS certified tax volunteer prepare and file your return for free or file on your own.

There is no penalty to file taxes to claim these credits and they do not affect any benefits you are already receiving.

Who is Eligible?

Low-to-moderate-income taxpayers may be eligible for the free tax preparation and filing service, including those with disabilities and limited English-language abilities.

The 2025 Tax Season began on January 20 and runs through April 15.

For more information, visit uwgc.org/freetaxprep.

Vevay Man Convicted of Murder, Mutilating Animals

Vevay Man Convicted of Murder, Mutilating Animals

Dillsboro Redevelopment Commission Accepting Proposals for Lenover Street Property

Dillsboro Redevelopment Commission Accepting Proposals for Lenover Street Property

Morris Firefighters Rescue Dog from Icy Pond

Morris Firefighters Rescue Dog from Icy Pond

Florence Man Arrested on Child Pornography Charges

Florence Man Arrested on Child Pornography Charges

Home & Outdoor Living Expo Planned for This Weekend

Home & Outdoor Living Expo Planned for This Weekend

Two Airlifted from Head-On Crash in Aurora

Two Airlifted from Head-On Crash in Aurora