The legislation now moves to the Senate for consideration.

Shutterstock photo.

INDIANAPOLIS - The Indiana House of Representatives today advanced State Rep. Randy Frye's (R-Greensburg) legislation that would phase-in a complete state income-tax exemption for military pay earned by active duty members.

Frye said unlike active duty National Guard and reserve members who are exempt from the individual income tax, other active duty members can qualify for a maximum $5,000 exemption. Frye's House Bill 1034, which now moves to the Indiana Senate for consideration, would start with a 25% exemption on military pay in 2024, 50% exemption in 2025, 75% exemption in 2026, and end with a full exemption by 2027.

"We need and want skilled veterans to call Indiana home," Frye said. "With this tax cut, we can incentivize more military members to settle here in our state, and help honor their commitment to serving our great nation."

Home & Outdoor Living Expo Planned for This Weekend

Home & Outdoor Living Expo Planned for This Weekend

Two Airlifted from Head-On Crash in Aurora

Two Airlifted from Head-On Crash in Aurora

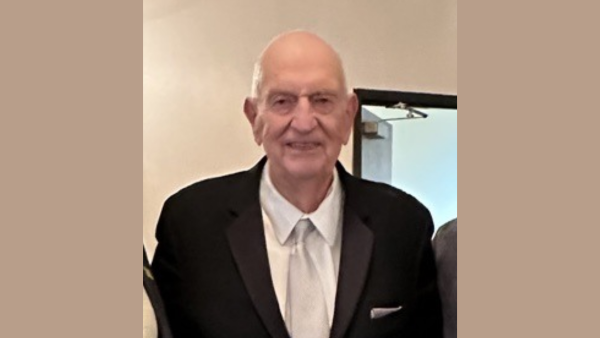

Milan '54 Team Member Gene White Passes Away

Milan '54 Team Member Gene White Passes Away

City of Florence Requests FBI Investigation Amid Revenue Diversion Activities

City of Florence Requests FBI Investigation Amid Revenue Diversion Activities

Three Airlifted from U.S. 421 Crash

Three Airlifted from U.S. 421 Crash

Women's Giving Circle Announces 2026 "Building the Next Chapter" Event Series

Women's Giving Circle Announces 2026 "Building the Next Chapter" Event Series