Internet sellers will have to pay state sales taxes on online sales to Hoosiers starting October 1.

(Indianapolis, Ind.) - Indiana residents purchasing products online from out-of-state sellers will soon be charged the state's seven-percent sales tax.

The Indiana Department of Revenue plans to begin enforcing the 2017 online sales tax state law on October 1 “on a prospective basis.”

The law requires retailers who annually sell at least $100,000 in the state or do business with more than 200 Indiana customers to collect and remit state sales tax.

The law was challenged in 2017, but wasn't immediately enforced. The state revenue agency says the lawsuit will likely be dismissed following the U.S. Supreme Court’s June ruling on online sales tax.

According to the DOR, remote sellers seeking to comply with the laws of multiple states, including Indiana, should register with the Streamlined Sales Tax Registration system at www.streamlinedsalestax.org. Remote sellers seeking to comply with only Indiana’s economic nexus law should register through the online portal, INBiz, at www.inbiz.in.gov.

RELATED STORIES:

Lawrenceburg State of the City Address Moved to Next Friday

Lawrenceburg State of the City Address Moved to Next Friday

Trevor Bischoff Announces Bid for Dearborn Co. Council District 4

Trevor Bischoff Announces Bid for Dearborn Co. Council District 4

FCN Makes Donation to Sunman Open Door Food Pantry

FCN Makes Donation to Sunman Open Door Food Pantry

Multiple Semis Involved in Crash on I-74

Multiple Semis Involved in Crash on I-74

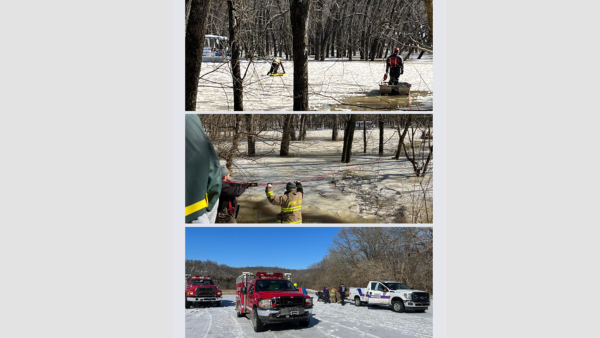

Dearborn Co. Water Rescue Urges Residents to Stay Off Ice

Dearborn Co. Water Rescue Urges Residents to Stay Off Ice

New Batesville Superintendent to Start Later This Month

New Batesville Superintendent to Start Later This Month