The legislation has passed an early hurdle.

(Indianapolis, Ind.) - A bill authored by State Senator Jeff Raatz has passed the Senate Committee on Education and Career Development.

Senate Bill 420 would created and Industry Credentialing Organization that funds work-based learning for students. The bill would also allow those who donate to the fund to receive a tax credit equal to 50 percent of their contribution.

“Right now, there are many high-paying jobs available in our workforce that require only a certification, not a college degree, and employers are struggling to find employees with the necessary skills to fill the positions,” Raatz said. “By creating an ICO and rewarding those who participate, Indiana could gain millions of dollars in private investment to fund apprenticeships, internships, graduation pathways and career coaching for students, leading them on a path to obtain a successful career.”

Under the bill, an ICO’s created would require an annual audit by a certified public accountant.

SB 420 now moves to the Senate Committee on Tax and Fiscal Policy.

Home & Outdoor Living Expo Planned for This Weekend

Home & Outdoor Living Expo Planned for This Weekend

Two Airlifted from Head-On Crash in Aurora

Two Airlifted from Head-On Crash in Aurora

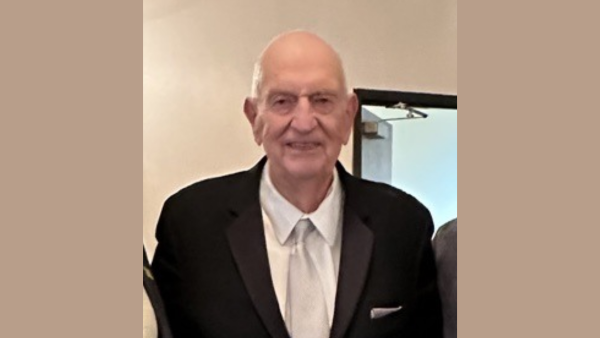

Milan '54 Team Member Gene White Passes Away

Milan '54 Team Member Gene White Passes Away

City of Florence Requests FBI Investigation Amid Revenue Diversion Activities

City of Florence Requests FBI Investigation Amid Revenue Diversion Activities

Three Airlifted from U.S. 421 Crash

Three Airlifted from U.S. 421 Crash

Former Boone Co. Sheriff Passes Away

Former Boone Co. Sheriff Passes Away