The IRS anticipates most refunds will be issued in less than 21 days after filing this year.

Shutterstock photo.

WASHINGTON, D.C. – The Internal Revenue Service (IRS) today announced the start date for the 2023 tax season.

Monday, January 23 is the day the agency will begin accepting and processing 2022 tax year returns.

More than 168 million individual tax returns are expected to be filed, with the vast majority of those coming before the April 18 tax deadline.

The IRS urges people to have all the information they need before they file a tax return. Filing a complete and accurate tax return can avoid extensive processing and refund delays as well as avoiding the possibility of needing to file an amended tax return.

Filing electronically with direct deposit is the fastest and easiest way to file and receive a refund. To avoid delays in processing, individuals should avoid filing paper returns wherever possible.

Below are several important dates taxpayers should keep in mind for this year's filing season:

- Jan. 13:IRS Free File opens

- Jan. 17: Due date for tax year 2022 fourth quarter estimated tax payment.

- Jan. 23: IRS begins 2023 tax season and starts accepting and processing individual 2022 tax returns.

- Jan. 27: Earned Income Tax Credit Awareness Day to raise awareness of valuable tax credits available to many people – including the option to use prior-year income to qualify.

- April 18: National due date to file a 2022 tax return or request an extension and pay tax owed due to the Emancipation Day holiday in Washington, D.C.

- Oct. 16: Due date to file for those requesting an extension on their 2022 tax returns.

For more information and helpful tips, visit www.IRS.gov.

Franklin Co. Residents Encouraged to Report Flooding Damage

Franklin Co. Residents Encouraged to Report Flooding Damage

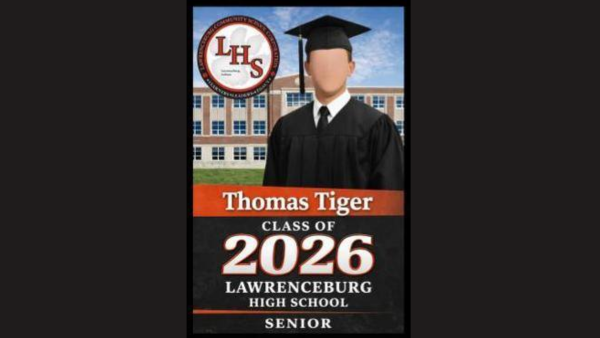

Lawrenceburg High School Announces New Tradition for Graduates

Lawrenceburg High School Announces New Tradition for Graduates

New Indiana Law: Penny-rounding for Retailers

New Indiana Law: Penny-rounding for Retailers

Jennings Co. Bridge Washes Away

Jennings Co. Bridge Washes Away

Local Schools Compete at 15th Annual Rube Goldberg Machine Contest

Local Schools Compete at 15th Annual Rube Goldberg Machine Contest

State Sen. Leising Welcomes Students to the Statehouse

State Sen. Leising Welcomes Students to the Statehouse